Three California metro areas are among the housing markets “cooling off most,” according to a recent study from SmartAsset.

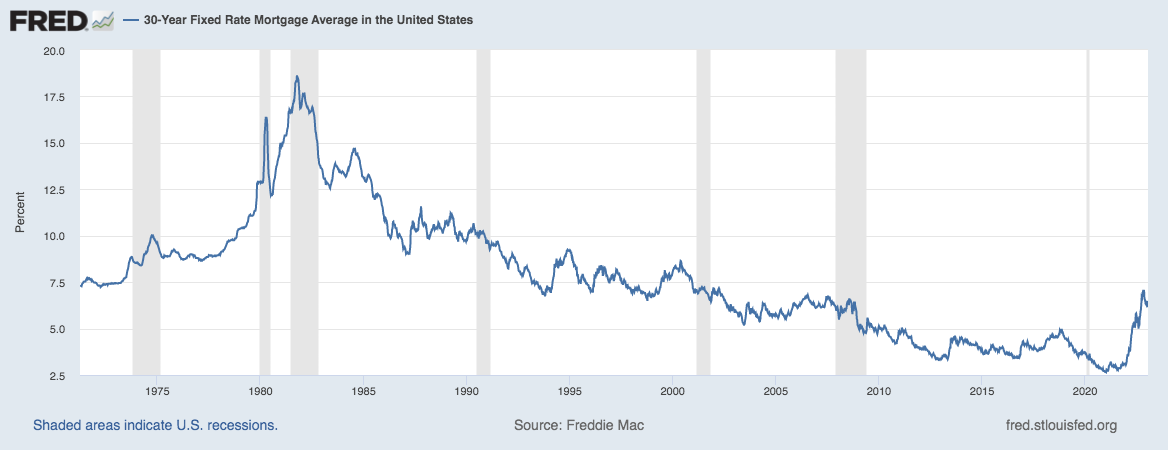

NORTHERN CALIFORNIA — As mortgage rates rise and home sales decline, housing prices have started to drop in Northern California and across the country.

In fact, home prices dropped 0.77 percent from June to July 2022, according to a recent report from Black Knight, a software, data and analytics company. That was the largest monthly decline since January 2011.

“After 31 consecutive months of growth, home prices pulled back by 0.77 percent in July,” said Ben Graboske, president of Black Knight. “Annual home price appreciation still came in at over 14 percent, but in a market characterized by as much volatility and rapid change as today’s, such backward-looking metrics can be misleading as they can mask more current, pressing realities.”

The company’s home price data has indicated a cooling housing market for several months, Graboske said.

“In January, prices rose at 28 times their normal monthly rate before slowing to five times average in February as interest rates began to tick up,” Graboske said. “Even May was still about two times normal, before June growth came in 70 percent below the long-run average. And all the while, annual appreciation continued to appear historically strong, showing double-digit growth month after month. Without timely, granular data, market-moving trends don’t become apparent until they’re right in front of you — like a sudden shift to the largest single-month decline in home prices in more than a decade.”

More than 85 percent of the 50 largest U.S. markets have seen prices come off their peaks through July, with one-third down more than 1 percent and about 1 in 10 down by 4 percent or more, according to the report. As a result, some homeowners are losing equity — especially those in major California metros.

“Some of the nation’s most equity-rich markets have seen significant pullbacks, most notably among key West Coast metros,” Graboske said.

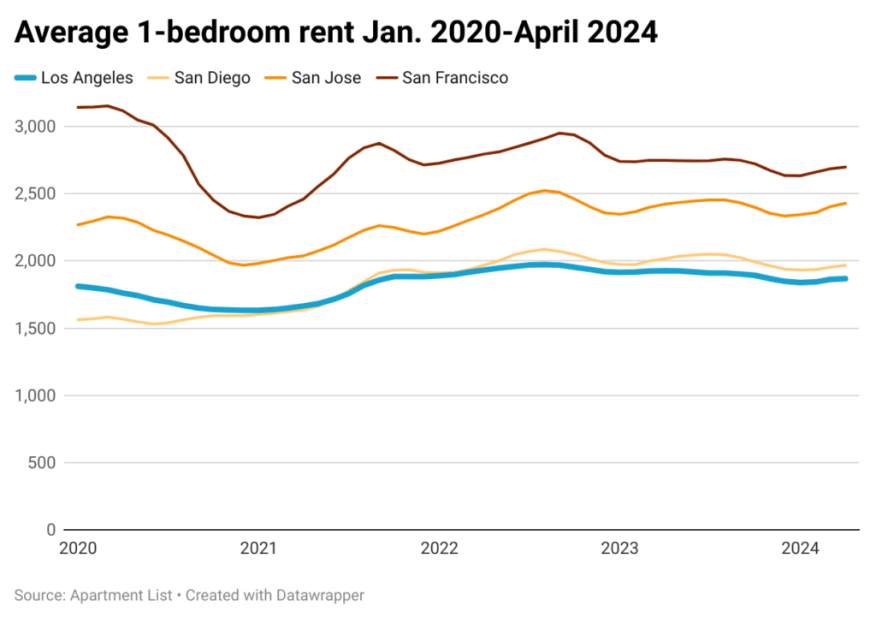

“From April through July, San Jose lost 20 percent of its tappable equity,” he said. “Seattle followed, shedding 18 percent of tappable equity over that same three-month span. Likewise, San Diego (-14 percent), San Francisco (-14 percent) and Los Angeles (-10 percent) have all seen double-digit declines since April.”

Home sales are down almost 18 percent since January 2022, according to the U.S. Census Bureau. But some areas have cooled more than others.

Three California metro areas are among the housing markets “cooling off most,” according to a recent study from SmartAsset.

SmartAsset, a financial advice resource, analyzed the 100 largest metro areas to determine the housing markets that have cooled down the most. The company compared 2021 and 2022 data across eight metrics, split into two categories: price reduction and decreased demand.

Boise, Idaho, has cooled the fastest, according to the report. However, three California metro areas, including the San Jose-Sunnyvale-Santa Clara area, rank among the top 10 places where the housing market has cooled off the most.

“In these areas, homes are staying on the market longer relative to a year ago — nearly double the amount of time,” the report said. “Moreover, all three areas have seen over a 33 percent decrease in the number of houses sold monthly from August 2021 to August 2022.”

The San Jose-Sunnyvale-Santa Clara metro area came in fourth, according to the report. The San Diego-Chula Vista-Carlsbad metro area ranked eighth, and the Stockton metro area ranked 10th.

“San Jose-Sunnyvale-Santa Clara, California ranks in the top 10 for both larger price reductions and lower demand,” the report said. “Houses are on the market for roughly 19 days (eighth-highest), which is a 90 percent increase since exactly one-year ago (18th-highest). There has also been a 43.17 percent decrease in the number of houses sold and 26.81 percent of current listings have a price cut.”

These are the top 10 housing markets that are cooling off most, according to the report:

- Boise, Idaho

- Austin-Round Rock-Georgetown, Texas

- Phoenix-Mesa-Chandler, Arizona

- San Jose-Sunnyvale-Santa Clara, California

- Las Vegas-Henderson-Paradise, Nevada

- Salt Lake City, Utah

- North Port-Sarasota-Bradenton, Florida

- San Diego-Chula Vista-Carlsbad, California

- Provo-Orem, Utah

- Stockton, California