Since 1991

A Leader in California Property Tax Reductions.

Let our team of real estate experts guide you through this market downturn.

Step 1

We File Your

Appeal

Once you submit your signed Agreement and Agent Authorization forms to us, we will prepare your application for appeal with the County Assessment Appeals Board.

Step 2

Prepare Your

Case

Our team of expert real estate analyst will prepare your custom tax appeal valuation for your property.

Step 3

Contest It

In Court

We will attend your scheduled Hearing Officer Program or Board Hearing date as your tax agents and fight against the County Assessor’s office to get you the MAXIMUM tax reduction.

Step 4

A Tax Refund Is In

Your Hands

After we successfully win your appeal at the hearing, we will work with the Auditor/Controller’s office to make sure that your tax refund check is sent directly to you.

$30,000 /year

2021 Base Value – Supplemental tax appeal resulted in a permanent 15% reduction. Owner received refunds of over $30,000.

$1,500 /year

2021 Prop 8 tax appeal resulted in a 9% reduction. Homeowner received a refund of over $1,500.

$3,000 /year

2020 Prop 8 tax appeal resulted in a 15% reduction. Condo owner received a refund of over $3,000.

Over $150,000 /year

Covid-19 2021 Prop 8 tax appeal resulted in a 35% reduction based on loss of revenue. Our client received a tax refund of over $150,000

$2,500 /year

2021 Prop 8 tax appeal resulted in a 10% reduction. Homeowners received a refund of over $2,500.

Our Numbers

We Get Results.

25K

Properties represented throughout California

$50B

In total County assessment roll value reductions

32 years

An experienced team of real estate professionals in business since 1991

Our Clients:

California utilities can be forced to pay higher property taxes than others, court rules

A state appeals court has overturned a ruling that could have cut property taxes on utility companies in California by $900 million a year, a tax burden that would have been mostly shifted to homeowners. The dispute involves property taxes on the debts faced by utilities for the funds they obtain from local revenue bonds. […]

Home Sales Slide..

Google has announced that they’ll be laying off 12,000 workers, following in the footsteps of Microsoft, Amazon, Salesforce and many other tech companies The housing market has also continued to slide, with sales volumes dropping for the 11th month in a row With the World Economic Forum being held in Davos, Switzerland this week, there […]

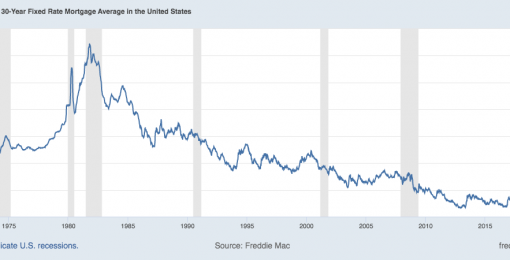

Home Prices Drop As Housing Market Cools In NorCal

Three California metro areas are among the housing markets “cooling off most,” according to a recent study from SmartAsset. NORTHERN CALIFORNIA — As mortgage rates rise and home sales decline, housing prices have started to drop in Northern California and across the country. In fact, home prices dropped 0.77 percent from June to July 2022, […]

SoCal home prices fall for sixth straight month

Home prices across Southern California have slipped for the sixth straight month, the result of increasing monthly mortgage rates. Prices in the lower half of the state fell for a sixth straight month in November, wiping out most of the price gains during the first half of 2022, the Orange County Register reported, citing CoreLogic data. […]